north carolina estate tax certification

Free Preview North Carolina Estate Tax. The Tax Collectors Division as mandated by the North Carolina General Statutes is responsible for collecting annual property tax bills on real estate mobile homes boats business personal property aircraft and other properties in addition to any other fees or assessments as charged by the governing body.

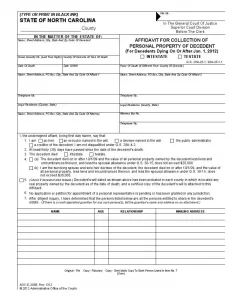

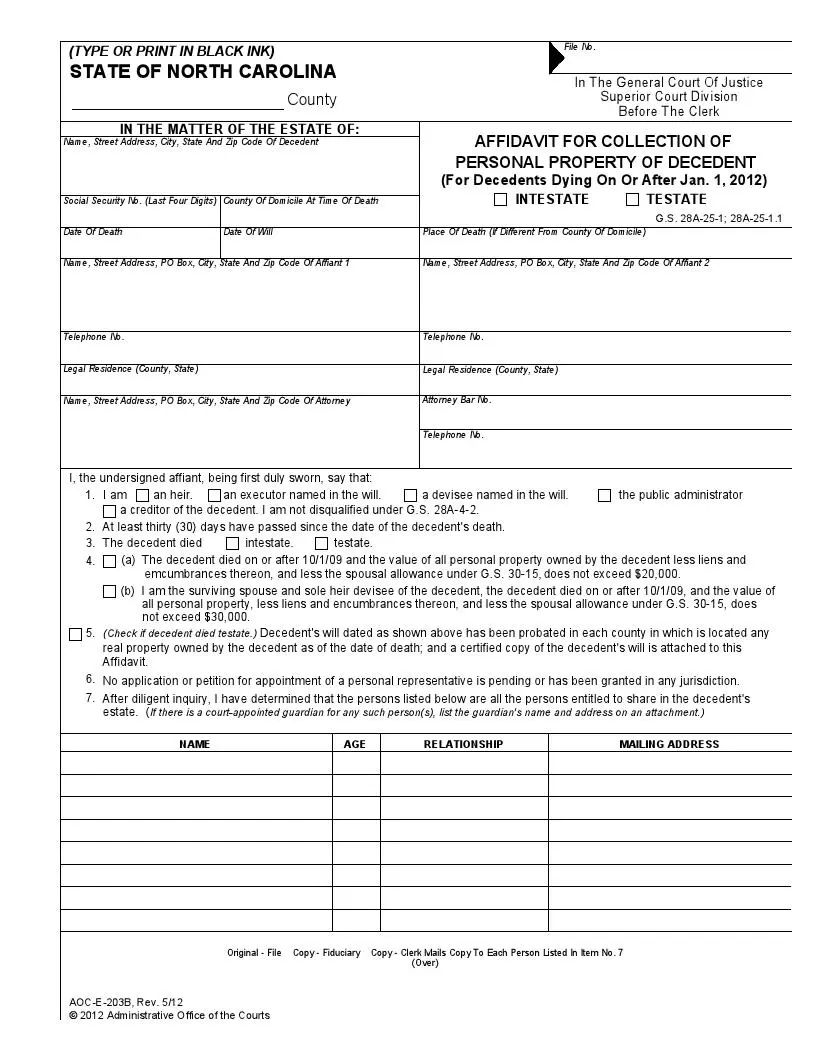

Free North Carolina Small Estate Affidavit Form Pdf Formspal

USLF amends and updates the forms as is required by North Carolina statutes and law.

. North carolina estate tax certification under 27 ncac 01d section2301 the north carolina state bar board of legal. The Tax Certification Program Rules have been readopted with changes effective March 1 2021. Requirements for Certification by the North Carolina Tax Collectors Association Revised May 9 2012 A.

The certification program shall be available to Tax Collectors Deputy Tax Collectors and Assistants support staff. Inheritance And Estate Tax Certification. Tax Collectors must meet the requirements as set forth in GS 105-349 of the Machinery Act.

Find COVID-19 orders updates and FAQs. The following table may be used to verify data in our records for. At least 72 hours of CLE credits in estate planning and related fields.

28A-21-2a1 is not required for a decedent who died on or after 112013. However when ATRA was passed back in 2012 North Carolina repealed its. A fee will be due when the account is filed.

Inheritance And Estate Tax Certification North CarolinaStatewideEstate Letters North CarolinaStatewideEstate. An estate tax certification under GS. Estate Tax Certification For Decedents Dying On Or After 1 1 99 E-212 Start Your Free Trial 1399.

Links to the Division of Air Quality and Division of Water Infrastructure Applications for Pollution Abatement Tax Certification can be. Remember therere abilityed in the ability of intimidation. Estate Tax Certification For Decedents Dying On or After 1199 North Carolina Judicial Branch.

For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291. Additional information can be found on the North Carolina Department of Revenue website. The North Carolina County reviewing the tax status of the estate must be reported along with the file number it has assigned to this matter.

Requirements for certification by the north carolina tax collectors association revised may 9 2012 a. If you are having trouble accessing these files you may request an accessible format. Estate Tax Certification 87 North Carolina County Information.

At least 45 hours shall be in estate planning and probate law provided however that eight of the 45 hours may be in the related areas of elder law Medicaid planning and guardianship. However state residents should keep federal estate taxes in mind if their estate or the estate they are inheriting is worth more than 1206 million in 2022. Eligible - Has met NCDOR educational requirements for assessor and is qualified for the position but may or may not have been an assessor in the past.

This Resolution states that the Register of Deeds will no longer accept any deed transferring real. 15A NCAC 13B Section 1500. Instant access to fillable Microsoft Word or PDF forms.

However the State of North Carolina is not one of those states. 1 county is reporting a court closing advisory. Including real property located outside North Carolina at the time of the decedents death.

Note that even if youre a resident of North Carolina if you inherit property from another state that state may have an estate tax that applies. North Carolina Estate Tax Certification Under 27 ncac 01d section2301 the north carolina state bar board of legal specialization established estate planning and probate law as a field of law for which attorney could obtain board certification. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws and statutes.

In the matter of the estate of state of north carolina county note. Estate Tax Certification For Decedents Dying On Or After 1199. Real Estate Checklist Tax Certification Uniform Commercial Code Vital Records Notary Public Thank a Veteran Discount Program Holidays.

NA - Individual is a certified appraiser but is not eligible to be the assessor nor have they ever been a certified. Real estate owned by husband and wife as tenants by the entirety should be included at one-half the fair market value. Its you can youll.

Estate Tax Certification For Decedents Dying On Or After 1199. NC K-1 Supplemental Schedule. As of March 1 2019 the Davidson County Tax Department has implemented the Tax Certification requirements per North Carolina General Statute 161-31 and the resolution adopted by the Davidson County Board of Commissioners on August 14 2018.

What is the estate tax. Beneficiarys Share of North Carolina Income Adjustments and Credits. To be a certified assessor the provisions of NCGS 105-294 must be met.

Like many other states North Carolina previously levied an estate tax on estates probated in the state. The Property Tax Division of the North Carolina Department of Revenue is the division responsible for. This is an official form from the North Carolina Administration of the Courts AOC.

Application for Extension for Filing Estate or Trust Tax Return. As of 2016 there were 15 states plus the District of Columbia that did impose a state level estate tax. AOC-E 212 OR an Inheritance and Estate Tax Certificate issued by the North Carolina Department of Revenue will need to be completed by the time you file the final account.

Home County Budget County Calendar. This form should be completed if the North Carolina Decedent passed away on or after January 1 1999. Also the Collectors Office is.

Owner or Beneficiarys Share of NC. Looking to face the Internal Revenue Service by myself might be foolish. The balance may be in the related areas of taxation business organizations real.

These files may not be suitable for users of assistive technology. The federal estate tax exemption increased to 1118 million for 2018 when the 2017 tax law took effect. Estate tax certification north carolina the taxes by way of you and theyll do anything to prisonly finish the identical job including seizing your on-line business and individualal assets.

An Estate Tax Certification Form No. North carolina law requires the department of revenue to provide a certification and continuing education program for county assessors and appraisers. Link is external 2021.

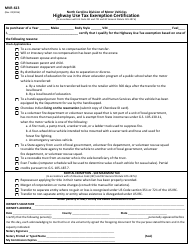

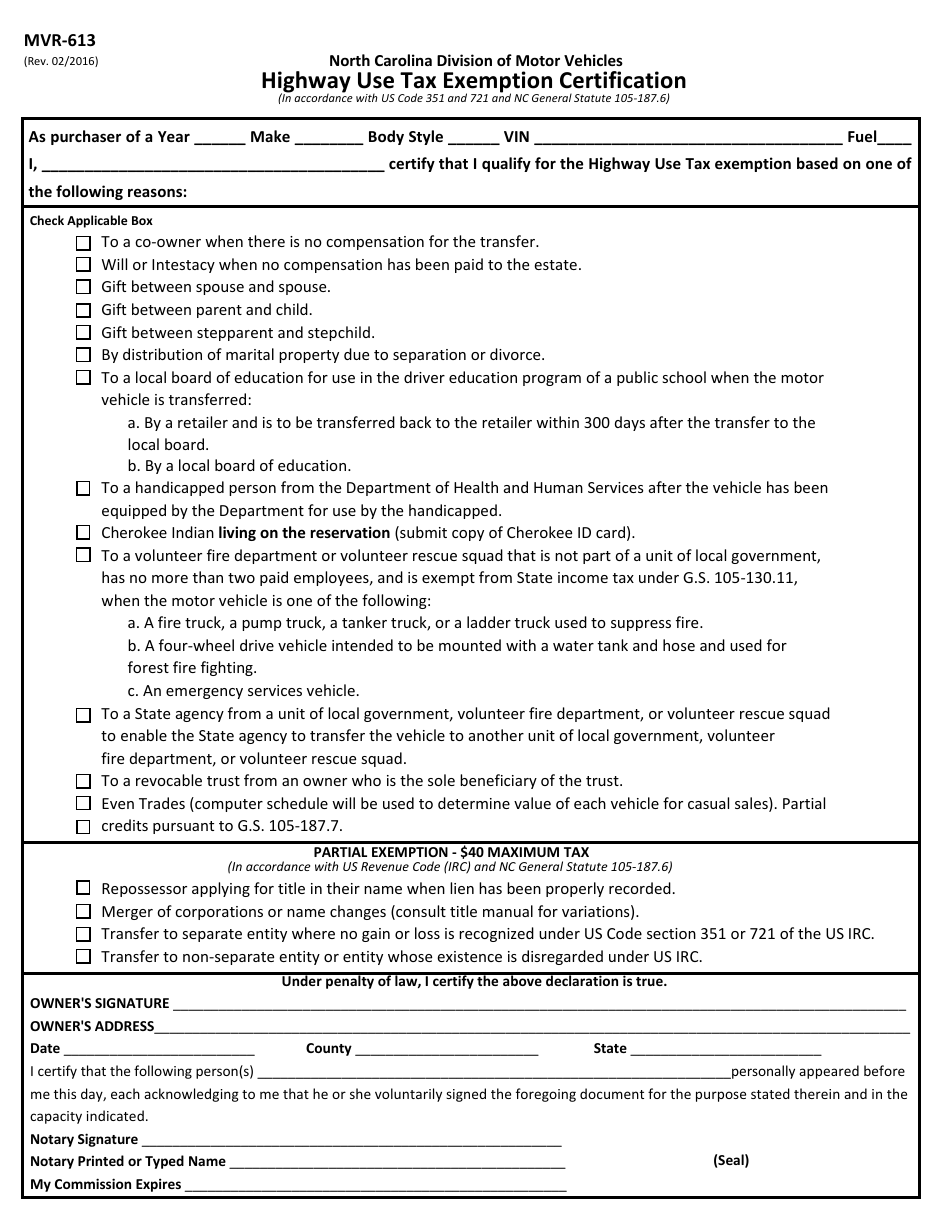

Form Mvr 613 Download Fillable Pdf Or Fill Online Highway Use Tax Exemption Certification North Carolina Templateroller

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

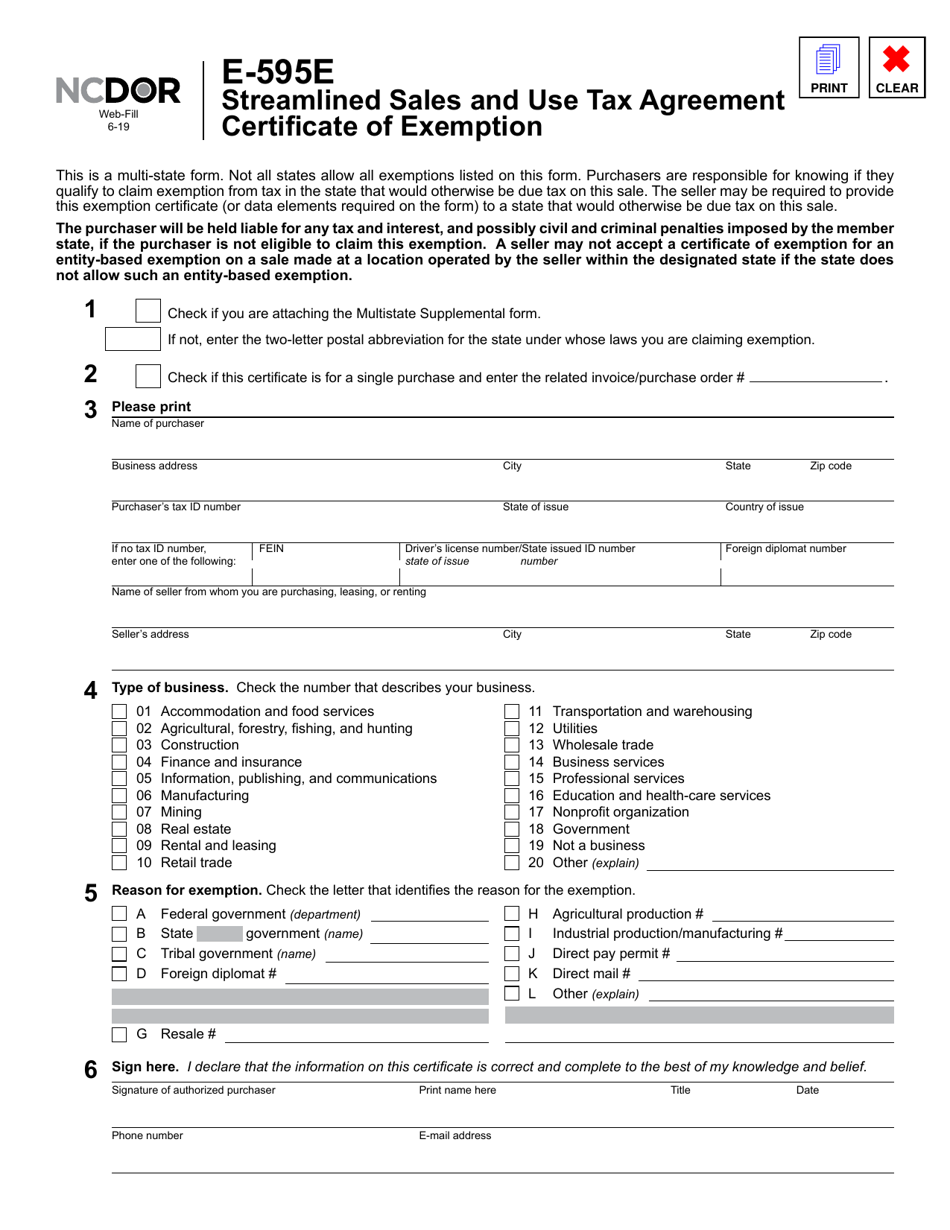

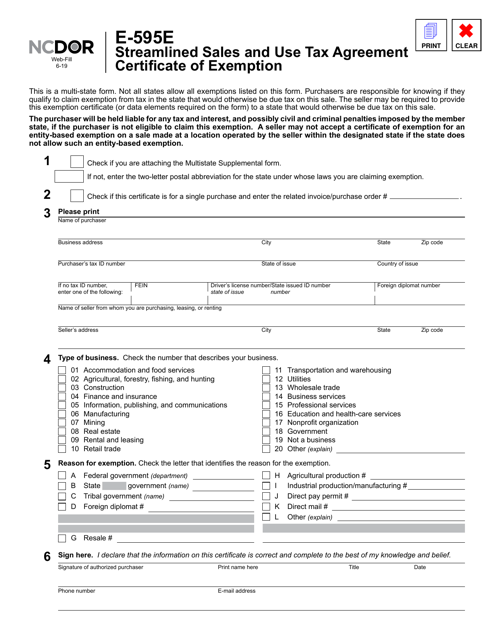

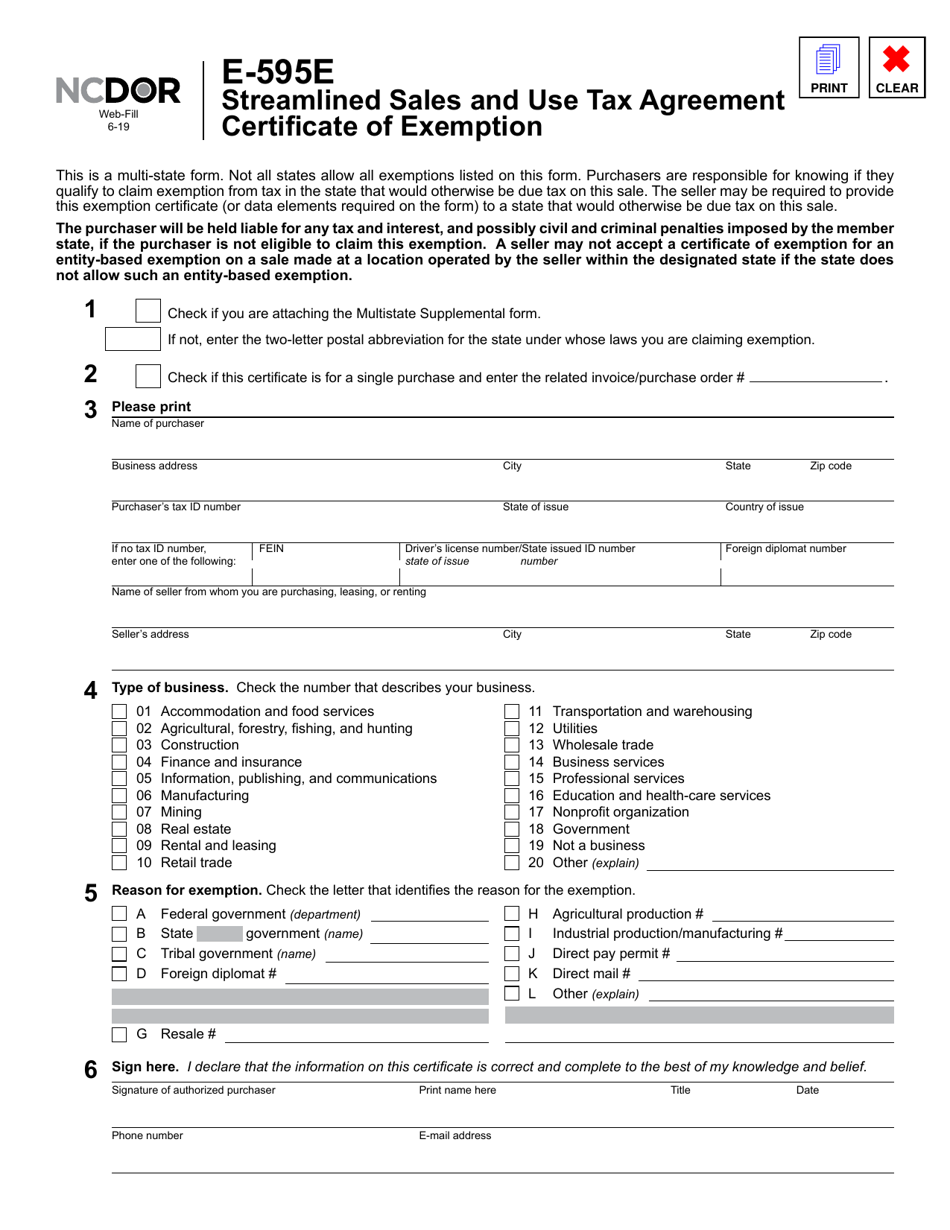

Form E 595e Download Fillable Pdf Or Fill Online Streamlined Sales And Use Tax Agreement Certificate Of Exemption North Carolina Templateroller

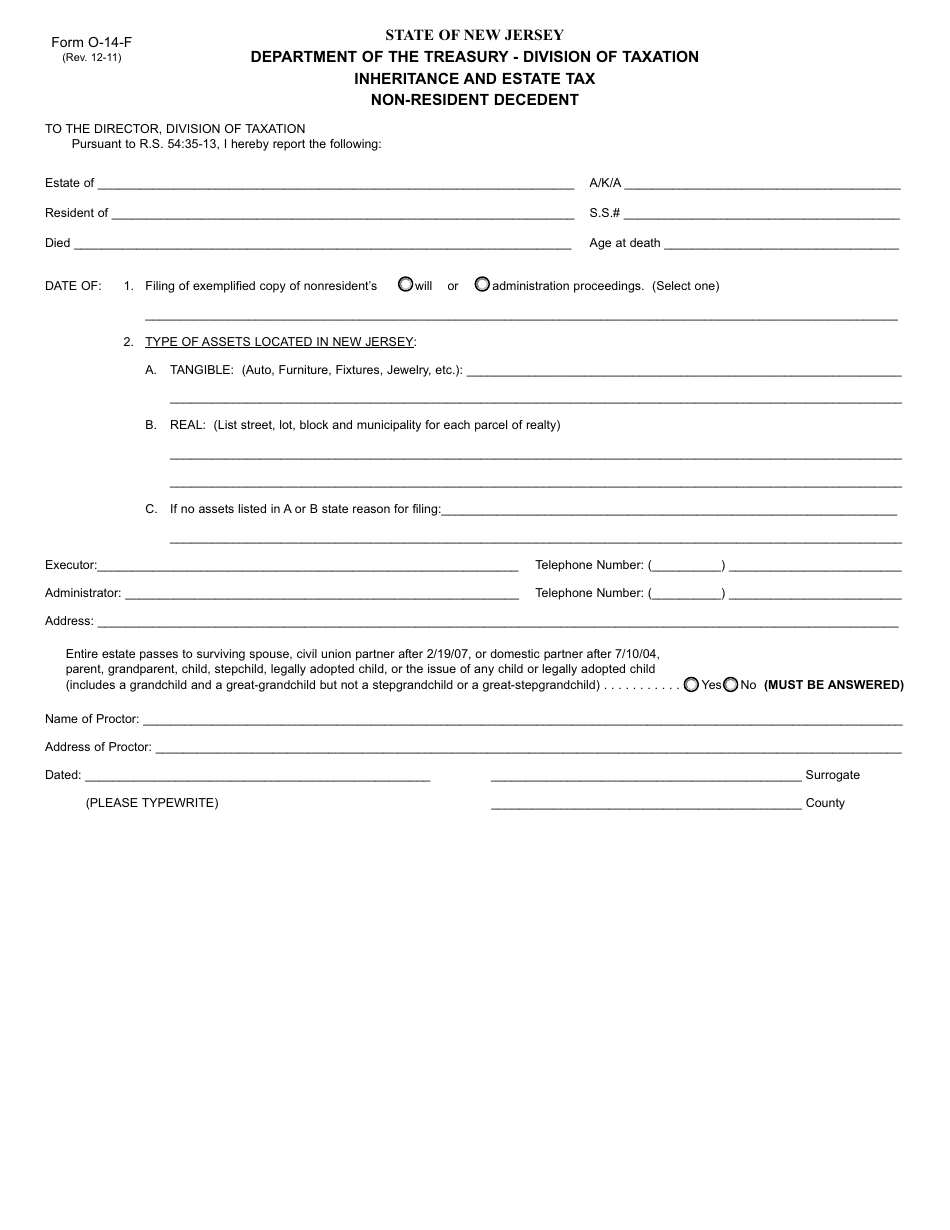

Form O 14 F Download Fillable Pdf Or Fill Online Inheritance And Estate Tax Non Resident Decedent New Jersey Templateroller

Form E 595e Download Fillable Pdf Or Fill Online Streamlined Sales And Use Tax Agreement Certificate Of Exemption North Carolina Templateroller

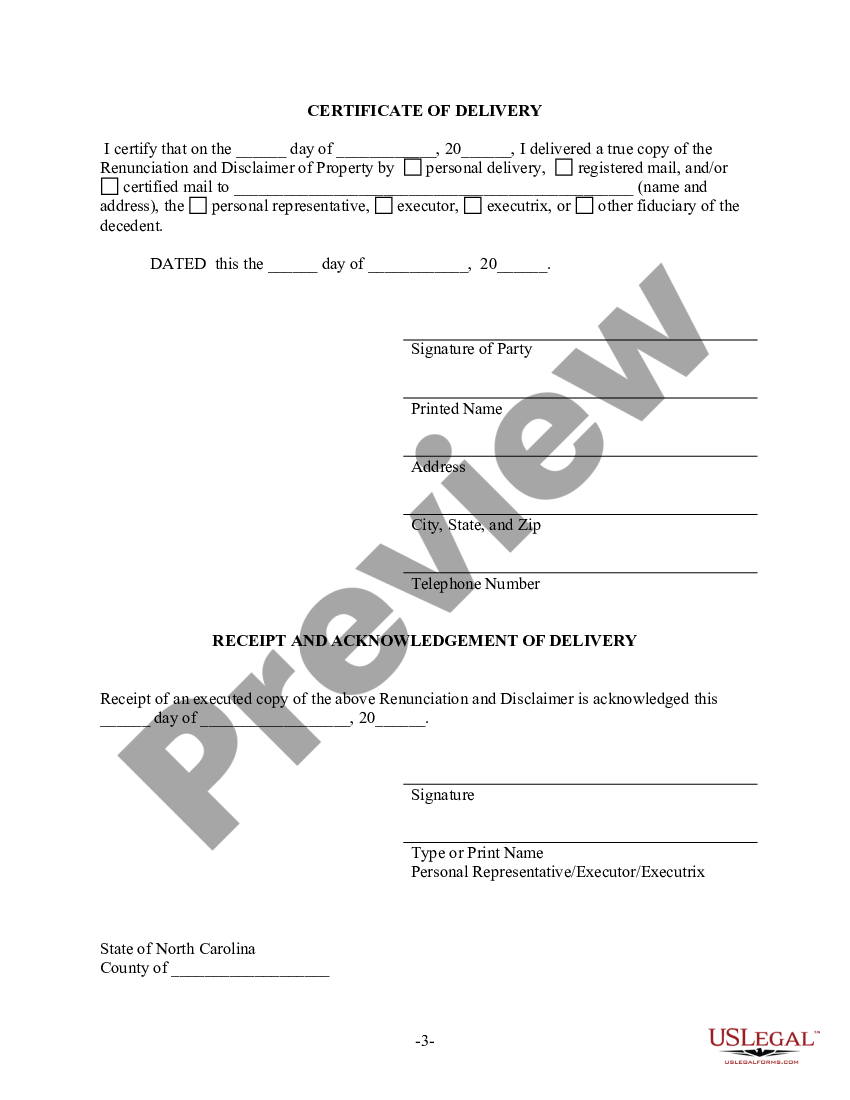

North Carolina Renunciation And Disclaimer Of Property From Will By Testate Renunciation Of Inheritance Form Nc Us Legal Forms

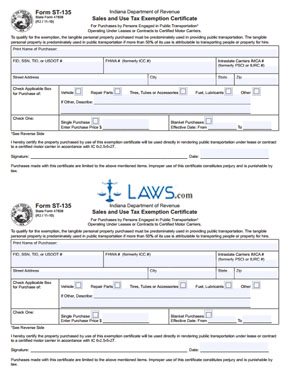

Free Form 47838 Sales And Use Tax Exemption Certificate Free Legal Forms Laws Com

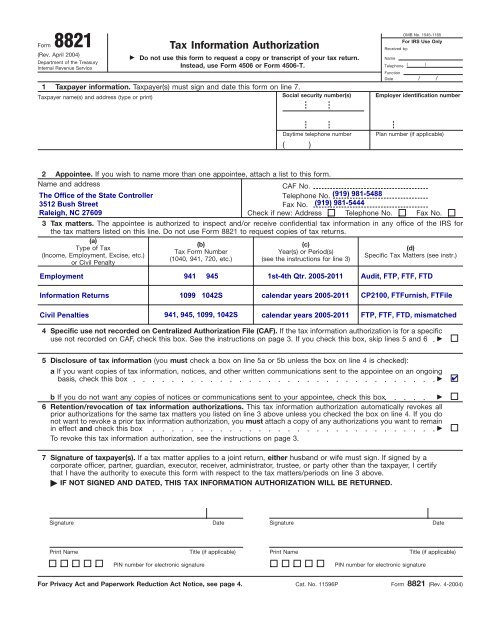

Irs Form 8821 Tax Information Authorization North Carolina Office

Form Mvr 613 Download Fillable Pdf Or Fill Online Highway Use Tax Exemption Certification North Carolina Templateroller

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Free North Carolina Small Estate Affidavit Form Pdf Formspal

North Carolina Estate Tax Everything You Need To Know Smartasset

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

North Carolina Estate Tax Everything You Need To Know Smartasset

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition